Ever heard of digital money that any government or bank doesn’t control? That’s cryptocurrencies, no coins, no bills—just virtual cash on the internet. Bitcoin kicked it off, and now there’s a gang of these digital currencies. It’s like Money 2.0, shaking up how we see and use our hard-earned bucks!

Furthermore, according to a recent lendingtree.com survey, 38% of cryptocurrency investors lost money, 28% made a profit, and 13% broke even.

Bitcoin was the first one, but now there are many others, like Ethereum and Ripple. People are getting into cryptocurrencies more and more. It’s changing how we think about money and finance. Some even see it as the future of buying and selling things.

Now, how do cryptocurrencies work? So, these cryptocurrencies work on some high-tech stuff. But I’m here to break it down for you, make it simple. No need for complicated jargon. Let’s get into it!

Digital vs. Traditional Currencies

Let’s talk money – the old-school way and the new digital way.

Traditional Currencies: The Classics

So, you know your regular dollars, euros, pounds – those are the classics, the traditional currencies. The physical bills and coins you can touch, stuff in your wallet, and use to buy your regular stuff.

Digital Currencies: The Techy Side

Now, on the techy side, we’ve got digital currencies. No paper, no metal – it’s all in the digital realm. Think Bitcoin, Ethereum, and others. Instead of a wallet bulging with bills, you have a digital wallet on your phone or computer storing these virtual bucks.

What’s the Big Difference?

The key thing? Who’s in charge? Traditional currencies have big shots like governments and banks calling the shots. They print the money, regulate it, and decide how it works. On the flip side, digital currencies are like rebels. No big boss – it’s decentralized. The power is in the hands of the people using it, not some central authority.

So, that’s the scoop: old-school physical money vs. the new-age digital cash. Both get the job done, but they’ve got their styles!

Key components of cryptocurrencies

Here are the critical components of how do cryptocurrencies work:

- Blockchain: The underlying technology that records all transactions securely and transparently, organized chronologically into blocks.

- Cryptographic Hash Functions: Used to secure data integrity and create unique identifiers for blocks and transactions, enhancing security.

- Decentralization: This is the cool part. Cryptocurrencies don’t have a boss. Unlike traditional centralized systems, cryptocurrencies operate on a decentralized network of nodes, preventing a single point of control and enhancing security.

- Consensus Mechanisms: Protocols used to achieve agreement on the state of the blockchain, such as Proof of Work (PoW) and Proof of Stake (PoS), ensure trust among participants.

- Wallets: Digital tools allow users to securely store and manage their cryptocurrency holdings, hardware-based (physical devices) or software-based (applications and online platforms).

- Private and Public Keys: Essential for securing transactions. The private key allows access to one’s funds, while the public key serves as an address for receiving funds.

- Smart Contracts: Self-executing contracts with the terms directly written into code, automating and enforcing agreements without intermediaries.

- Mining: The process of validating and adding transactions to the blockchain, typically associated with Proof of Work consensus mechanisms.

- Digital Signatures: Authentication method using cryptographic techniques, ensuring the origin and integrity of transactions.

- Initial Coin Offering (ICO) or Token Sale: A fundraising method where new cryptocurrencies are sold to investors, providing capital for project development.

- Forks: Changes or updates to the blockchain protocol, creating alternative versions (hard forks) or temporary deviations (soft forks) in the network.

- Exchanges: Platforms where users can buy, sell, and trade cryptocurrencies with other users, converting them into fiat currency or other digital assets.

- Volatility: Cryptocurrency prices can experience significant fluctuations due to market demand, speculation, and external factors, making them attractive but risky investments.

- Regulatory Landscape: Governments and regulatory bodies worldwide are crucial in shaping cryptocurrencies’ legal status and acceptance.

How Do Cryptocurrencies Work? Explaining Cryptocurrency In 5 steps

Cryptocurrency, a revolutionary digital or virtual currency, operates on a decentralized network using cutting-edge technology like blockchain. Therefore, the question arises: how do cryptocurrencies work? Explaining this innovative concept involves breaking it down into five key steps.

1- Encryption in Cryptocurrency Transactions

Encryption is like a secret code that ensures information security during transactions. How do cryptocurrency work? In cryptocurrency, the transaction details are protected, making it difficult for unauthorized parties to understand or alter the information.

How Public Keys Identify Users:

- Public Key: Think of it as your digital address. It’s openly shared and used by others to send you cryptocurrency.

- When someone sends you funds, they use your public key to specify the transaction’s destination.

- It’s safe to share your public key because it only helps identify where funds should go, but it can’t be used to access your funds.

Importance of Private Keys for Security:

- Private Key: This is like your secret password. It’s known only to you and is crucial for accessing and managing your cryptocurrency.

- Your private key creates a digital signature for each transaction you make, proving that you are authorizing the transaction.

- Never share your private key. It’s the key to your wallet, and anyone with access to it can control your funds

2- Blockchain Ensures Transparency and Security

It’s challenging to alter or delete once a block is added to the blockchain. This immutability is a key feature that enhances security and trust.

Each block contains a unique code (hash) based on its content and the previous block’s hash. How do digital currency work in blockchain? If someone tries to change the information in a block, it would require changing the data in all subsequent blocks, which is practically impossible due to the decentralized nature of the network.

Consensus Algorithms (e.g., Proof of Work, Proof of Stake):

- Proof of Work (PoW): Miners compete to solve complex mathematical problems. The first solution gets the right to add a new block and is rewarded with cryptocurrency. PoW ensures that adding a block to the blockchain requires real-world computational effort, making it costly and time-consuming to attack the network.

- Proof of Stake (PoS): Validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. PoS aims to be more energy-efficient than PoW while providing a secure and decentralized consensus mechanism.

3- Types of Cryptocurrency Wallets

The type of cryptocurrency you choose, Bitcoin for decentralization or Ethereum for smart contracts, depends on your specific needs and preferences.

Hot Wallets:

- These are wallets connected to the internet and are more suitable for frequent transactions.

- Examples include online wallets, mobile wallets, and software wallets.

- They are convenient for everyday use, but they can be more vulnerable to hacking since they are always connected to the internet.

Cold Wallets:

- Cold wallets are offline and not connected to the internet.

- Examples include hardware wallets (physical devices like USB sticks) and paper wallets (physical documents with your wallet information).

- Cold wallets provide enhanced security because they are not susceptible to online hacking threats. They are ideal for long-term storage of cryptocurrency.

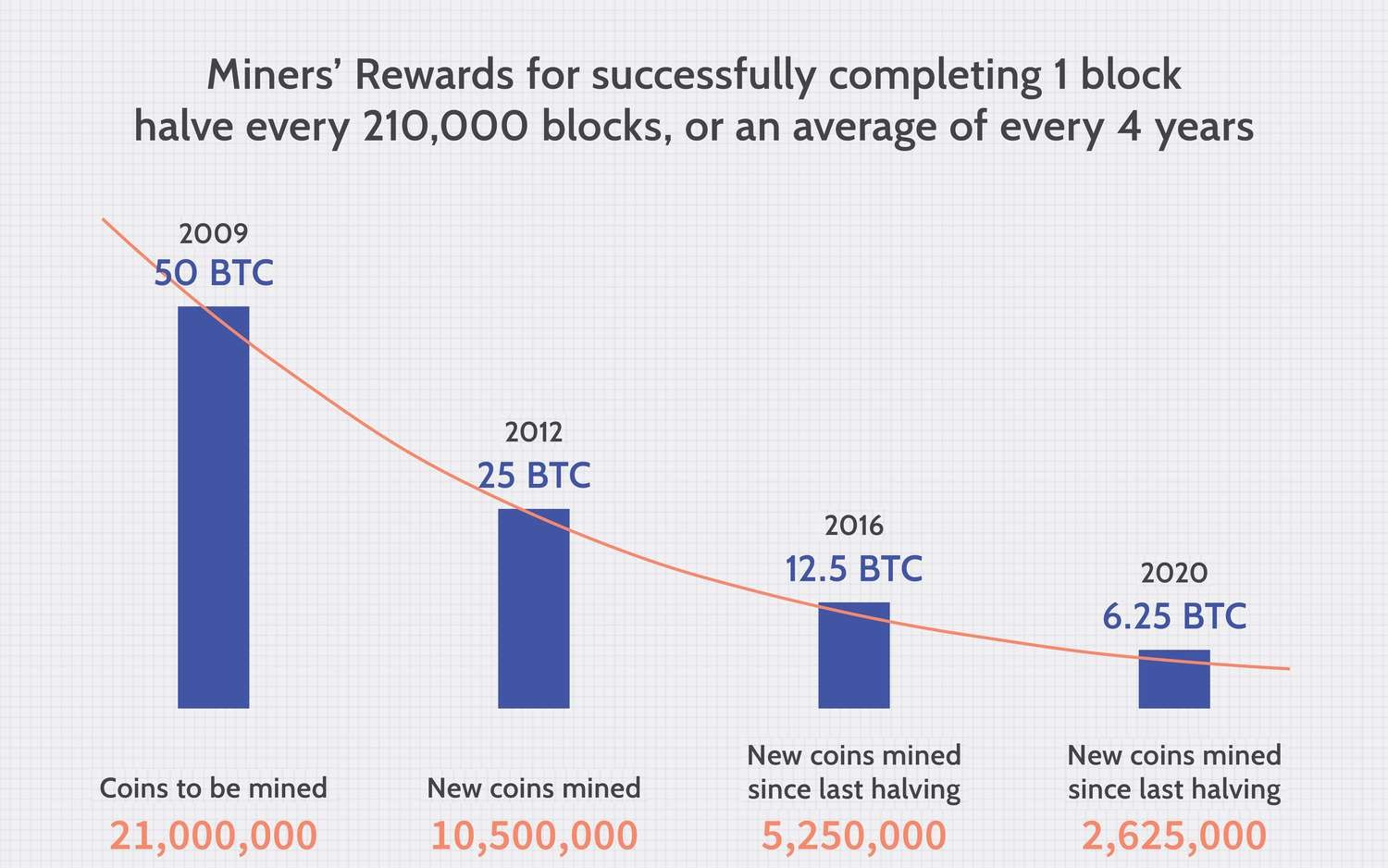

4- Role of Miners in the Validation Process

Miners play a key role in the validation process, especially in Proof of Work systems. They collect and validate pending transactions, organizing them into a block. To add this block to the blockchain, miners must solve a complex mathematical problem (Proof of Work).

This requires significant computational power and serves as a security measure, making it difficult for malicious actors to manipulate the transaction history.

Once the problem is solved, the new block is broadcasted to the network and added to the blockchain.

Miners are rewarded with newly created cryptocurrency (block reward) and transaction fees for their efforts, providing an incentive for maintaining the security and functionality of the network.

5- Transactions and Smart Contracts

Nodes on the network then verify transactions. In Proof of Work (PoW) systems, miners play a crucial role in this verification process. Smart contracts are self-executing contracts with the terms directly written into code. They automatically execute and enforce predefined rules and agreements when certain conditions are met.

Smart contracts run on the blockchain, ensuring transparency and security.

For example, in Ethereum, a blockchain known for its smart contract functionality, these contracts are programmed using the Solidity language.

Smart contracts find applications in various fields, including decentralized finance (DeFi), supply chain management, and voting systems.

They eliminate the need for intermediaries and reduce the risk of fraud by automating and securing the execution of agreements.

Read the Cryptocurrency Market Analysis and get the latest updates on crypto news.

Conclusion

So, we have discussed how do cryptocurrencies work; whether you’re excited about the decentralized power, the direct transactions, or the potential revolution in finance, keep an eye on the crypto space. The future of money is one click away in your digital wallet.

And there you have it, the lowdown on cryptocurrencies – from digital wallets to smart contracts. It’s like money but with a high-tech twist. As these digital currencies continue to gain momentum, they’re reshaping how we think about transactions and the entire financial landscape.