Palantir Technologies, Inc. stands at the forefront of data analytics and software development, offering innovative solutions that serve as central operating systems for various industries. Founded in 2003 by Alexander Karp, Peter Thiel, Stephen Cohen, and Nathan Gettings, Palantir has rapidly evolved into a key player in both commercial and government sectors.

The latest trends are shaping Palantir’s PLTR stock forecast performance, examining insightful trends provided by industry analysts and uncovering key insights into the company’s financial outlook. From understanding market dynamics to exploring Palantir’s growth potential, we’ll equip you with the knowledge to make informed investment decisions.

Palantir’s Path to Growth

Recently, PLTR stock witnessed a notable 3.24% surge, signaling investor confidence. Analysts predict a substantial 67.01% upward trend over the next three months, showcasing the company’s promising outlook.

Despite insider selling signals, short-term indicators advocate for a potential buying opportunity, indicating a positive market sentiment. Competing in the technology sector alongside industry giants like Roper Technologies and Autodesk, Palantir boasts a significant market capitalization of $54.37 billion.

With a core focus on developing and deploying innovative software platforms, Palantir is a pivotal operating system for diverse industries. Its Commercial segment caters to non-government clients, while the Government segment delivers solutions to various US and international government agencies.

Palantir’s stellar performance, consistently outperforming its industry peers, underscores its resilience and growth potential.

PLTR Stock Forecasts

Palantir Technologies (PLTR) is on an upward trajectory, evidenced by its recent 3.24% gain in stock value. With a market capitalization of $54.88 billion, Palantir operates at the forefront of technology services, serving both commercial and government sectors.

In the last quarter of 2023, PLTR stock forecast reported a total revenue of $608.35 million, marking a 14.07% increase year-over-year. Despite its high price-to-earnings ratio of 269.11x, PLTR attracts investor attention, with analysts projecting a median 12-month price target of $21.00.

Analyzing PLTR’s stock performance, it’s evident that the company is positioned for growth. Investors are optimistic about Palantir’s future, with a 1-year PLTR stock forecast indicating a potential high of $35.00. Moreover, insider trading data reveals a mixed sentiment, with insiders selling more shares than buying, which could be interpreted cautiously.

While short-term signals suggest a buying opportunity, long-term trends point to a positive outlook for PLTR stock forecast, as investors navigate market fluctuations, understanding Palantir’s trajectory and forecasted trends becomes imperative for making informed investment decisions.

Palantir Technologies Trends

| Trends | Information |

| Stock Performance | PLTR gained 3.24% on March 20, 2024. 52-week range: $7.28 – $27.50. |

| Financials | Q4 2023 revenue: $608.35 million (14.07% YoY increase). Net income: $93.39 million (232.03% YoY increase). Earnings per share: $0.04. |

| Forecast | Analysts project a median 12-month price target of $21.00. 1-year forecast high: $35.00. |

| Insider Trading | Insiders sold 19.15 million shares in the last 100 trades. The last trade was made by Stat Lauren Elaina Friedman, selling 6,000 shares. Mixed sentiment among insiders: more selling than buying. |

| Market Capitalization | Market cap: $54.37 billion. PLTR is categorized as a large-cap stock. |

PLTR Stock Forecast Insights

1. Stock Performance:

PLTR stock forecast has shown a mixed performance in recent days, with fluctuations in price. While it gained 3.24% on Wednesday, March 20, 2024, closing at $24.57, it experienced a 1.12% rise overall.

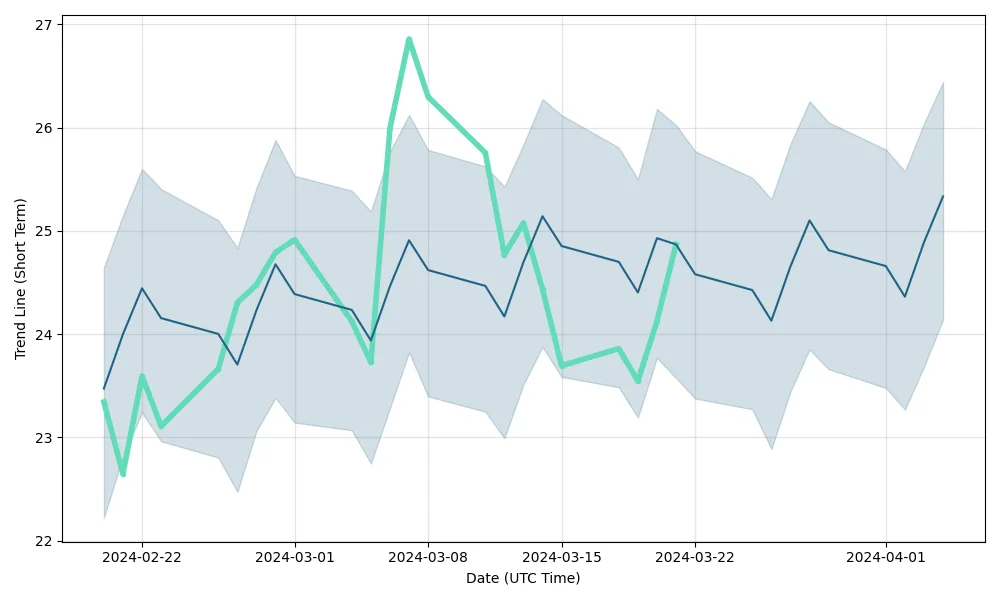

2. Short-Term Trend:

The stock is currently in the middle of a strong rising trend in the short term, indicating potential further growth. Analysts predict a 67.01% increase in the next 3 months, with a price range of $37.56 to $47.02.

3. Technical Signals:

While there are mixed signals in the stock, buy signals from short and long-term moving averages suggest a positive outlook. However, a sell signal from the 3-month Moving Average Convergence Divergence (MACD) indicates caution.

4. Support and Resistance Levels:

Palantir finds support at $24.51, potentially offering buying opportunities. Resistance is observed at $25.05. The stock’s average volatility and risk are considered medium.

5. Insider Trading:

Insiders have been selling more shares than buying, which could be seen as a negative signal. However, short-term signals and overall trends suggest a buying opportunity.

Palantir’s Role in the Tech Sector

Palantir Technologies plays a crucial role in the technology sector as a software platform provider that serves as a central operating system for various industries. Founded in 2003, the company operates under commercial and government segments, catering to non-government and government agencies.

Its software platforms help organizations analyze and manage vast amounts of data efficiently, enabling them to make informed decisions and solve complex problems.

With 3,735 employees, Palantir has become a key player in the packaged software industry. Its focus on building and deploying advanced software solutions has led to significant growth and market expansion.

Palantir’s technology has been instrumental in finance, healthcare, defense, and intelligence.

In the highly competitive tech landscape, Palantir stands out for its innovative data analysis approach and commitment to providing cutting-edge solutions to its clients.

By harnessing the power of data, Palantir empowers organizations to unlock valuable insights and drive meaningful outcomes, contributing to advancing the technology sector.

What to Expect from PLTR Stock?

Investors eyeing Palantir Technologies (PLTR) can anticipate several key factors influencing its performance. With a market capitalization of $54.88 billion, PLTR has become a prominent player in the technology sector. Analysts’ PLTR stock forecasts suggest a mixed outlook, with 25% recommending buying, 40% holding, and 35% selling the stock.

Recent trends indicate that PLTR stock has been trading near its 52-week high and above its 200-day moving average, signaling positive momentum. However, the stock has experienced fluctuations, with a recent 3.24% increase on March 20, 2024. Despite this, it’s important to note that falling volume on higher prices could indicate divergence and potential changes ahead.

Analyst Price Targets

In the past three months, 13 Wall Street analysts have provided price forecasts for Palantir Technologies. Their predictions suggest that the stock’s average price target is $19.64, with the highest estimate at $35.00 and the lowest at $5.00. This average price target reflects a decrease of -19.87% from the current price of $24.51.

Analysts predict a 67.01% rise in PLTR stock over the next three months, with a price range of $37.56 to $47.02. However, it’s essential to consider technical indicators, such as the Moving Average Convergence Divergence (MACD), which currently signals a sale.

Additionally, insider trading activity suggests a negative sentiment, with more shares being sold than bought.

While analysts foresee potential growth for PLTR stock in the short term, investors should remain vigilant and consider various indicators, including market trends and insider activity, to make informed decisions.

Some Strategies for Investing in Palantir

- Diversify your portfolio by allocating a portion to Palantir stock.

- Consider the long-term growth potential of Palantir’s technology solutions.

- Stay updated on Palantir’s market trends and analyst PLTR stock forecasts.

- Monitor Palantir’s financial performance and earnings reports.

- Assess Palantir’s competitive position within the tech industry.

- Evaluate Palantir’s partnerships and contracts with government and commercial clients.

- Be prepared for volatility in Palantir’s stock price and use it as an opportunity to buy or sell strategically.

- Consider consulting with a financial advisor before making investment decisions in Palantir.

How is Palantir Shaping the Future?

Palantir Technologies is revolutionizing the future by providing advanced software platforms as central operating systems for various industries. Through innovative data analysis and integration solutions, Palantir empowers organizations to make better decisions, enhance operational efficiency, and mitigate risks.

Its technology enables clients to harness the power of big data and artificial intelligence, unlocking valuable insights to drive growth and innovation. Palantir’s contributions extend beyond commercial sectors, as government agencies also utilize its platforms to address complex challenges like national security and public safety.

With a focus on driving meaningful impact and transforming industries, Palantir is at the forefront of shaping a data-driven future where businesses and governments can thrive.

Final Words

Palantir Technologies, a leader in data analysis software, is poised for growth despite recent fluctuations in its stock price. Analysts project a promising future, with a PLTR stock forecasted average price target of $19.64, representing a -19.87% change from its current price of $24.51. Palantir’s innovative solutions and strong financial performance indicate potential for long-term success. Despite short-term market volatility, Palantir’s role in shaping the future of data analytics remains significant, making it an attractive investment option. Investors should consider its steady growth trajectory and market-leading position when making investment decisions.