Are you contemplating your next investment move? If so, it’s time to consider Amazon stock. As one of the most influential players in the market, Amazon’s dominance extends far beyond just e-commerce. With its innovative ventures, expansive reach, and consistent growth, Amazon has solidified itself as a critical driver of change in the business world. In this discussion, we’ll uncover how to buy Amazon stock and why purchasing Amazon stock now could be a strategic decision backed by expert insights and market analysis.

Analysts maintain optimistic views on Amazon’s stock, affirming its positive outlook. Price targets span from $175.00 to $225.00, reflecting the company’s robust performance and growth prospects, particularly in sectors such as grocery and entertainment.

Understanding Amazon’s Growth Trajectory:

Amazon’s journey from an e-store to a global e-commerce behemoth is a testament to its remarkable evolution. Founded by Jeff Bezos in 1994, it all started as a humble online bookstore before swiftly expanding its offerings to include various product categories.

Over the years, Amazon’s relentless focus on customer satisfaction, innovative technologies, and strategic acquisitions propelled its growth trajectory. Today, Amazon’s influence spans diverse sectors, making it a dominant force in the global marketplace.

Analysis of Amazon’s Current Market Position:

Amazon’s current market position is nothing short of formidable. As the best online retailer in the world, Amazon commands a significant share of e-commerce sales globally. Its Prime subscription service, offering fast shipping and access to a vast digital content library, has amassed millions of loyal subscribers.

Furthermore, Amazon Web Services (AWS), the company’s cloud computing division, has emerged as a leader in the cloud infrastructure services market, contributing significantly to Amazon’s overall revenue and profitability. With its extensive network of fulfillment centers, robust logistics infrastructure, and relentless focus on innovation, Amazon continues strengthening its market position and expanding its reach.

Recent Developments in Amazon’s Business Strategy:

Amazon’s business strategy has evolved to adapt to changing market dynamics and capitalize on emerging benefits. Recent developments include expanding its grocery offerings through acquisitions like Whole Foods Market and the launch of Amazon Fresh stores.

Amazon has significantly invested in original content production and streaming services, enhancing its presence in the entertainment industry. Moreover, initiatives like drone delivery, cashierless stores, and investments in artificial intelligence underscore Amazon’s commitment to innovation and staying ahead of the curve. These strategic moves reinforce Amazon’s competitive edge and position the company for sustained growth in the future.

Reasons Why You Should Invest in Amazon Stock:

Investing in Amazon stock offers a compelling opportunity for several reasons. First and foremost, Amazon’s dominance in the e-commerce industry is unparalleled, giving it a significant advantage in capturing a large share of online retail sales.

Amazon’s diverse revenue streams, including its highly profitable cloud computing division, Amazon Web Services (AWS), provide stability and potential for continued growth. Moreover, Amazon’s commitment to innovation, evidenced by initiatives like Prime membership benefits and expansion into new markets like grocery and entertainment, ensures its relevance and competitiveness in the ever-changing business landscape.

Furthermore, Amazon’s strong financial performance, visionary leadership, and track record of long-term success make it an attractive investment plan for those seeking new opportunities to be a market leader with vast potential for future growth and value creation.

1- AWS: A Turnaround in Progress:

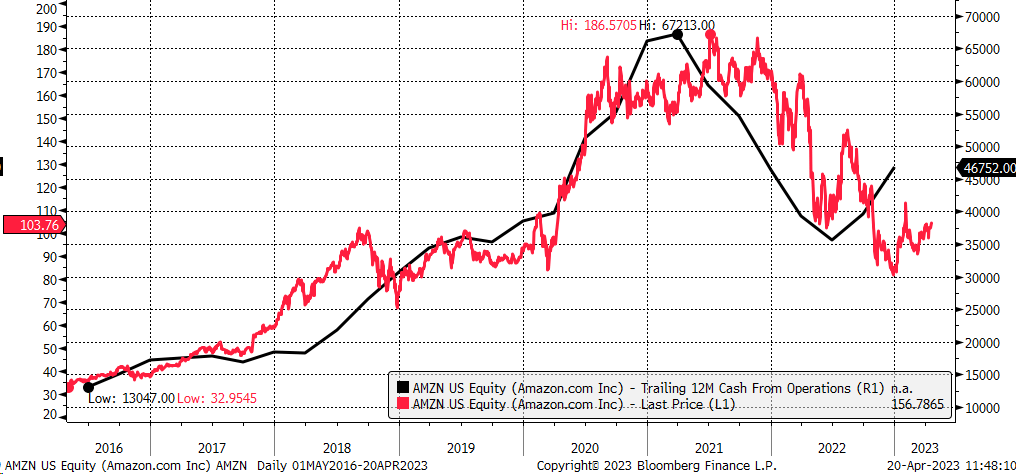

AWS, Amazon’s cloud computing business, has emerged as a crucial profit driver. Despite the North American commerce segment generating $6.5 billion in operating benefits in the fourth quarter, the international business incurred a loss of $419 million.

However, AWS compensated for this shortfall by generating $7.2 billion in operating profits despite its lower sales figures than North American commerce.

Although AWS experienced a slight dip in profitability with a 24% operating margin in the fourth quarter of 2022, it swiftly rebounded in 2023, achieving a 30% operating profit margin.

One notable aspect is AWS’s growth trajectory. In the fourth quarter, AWS saw a 13% increase in revenue, while competitors such as Google Cloud and Microsoft Azure experienced revenue growth in the 20% range. While several factors contribute to this trend, Amazon’s management anticipates adopting new workloads will drive AWS’s growth throughout 2024. This growth is critical given AWS’s significant role in Amazon’s overall profitability.

Also read: Palantir Technologies PLTR Stock Forecasts, Trends, and Insights

2- Explosive Growth Potential:

Amazon’s explosive growth potential stems from its relentless pursuit of expansion into new markets and innovative ventures. One of the key drivers of this growth is Amazon Web Services (AWS), the company’s cloud computing arm. AWS has become a dominant cloud service industry, providing scalable and reliable infrastructure for businesses worldwide. With the increasing demand for cloud services, AWS is well-positioned to capitalize on this trend and further bolster Amazon’s revenue streams.

Additionally, Amazon’s foray into digital streaming services, exemplified by Prime Video, has been met with significant success. Prime Video’s content library and competitive pricing make it a formidable contender, driving subscriber growth and contributing to Amazon’s overall revenue growth as the streaming market expands.

Amazon’s ventures into other sectors, such as grocery delivery with Amazon Fresh and healthcare with initiatives like Amazon Pharmacy, demonstrate the company’s agility in identifying and capitalizing on emerging trends. By diversifying its offerings and expanding into adjacent markets, Amazon strengthens its competitive position and opens significant avenues for revenue generation and market penetration.

3- Strong Financial Performance:

Amazon’s strong financial performance, characterized by consistently growing revenue and impressive profit margins, is a cornerstone of its success. Despite being one of the world’s biggest companies, Amazon outperforms expectations, demonstrating its resilience and ability to navigate dynamic market conditions. The company’s growth is fueled by its diverse revenue streams, from e-commerce sales to cloud computing services, entertainment subscriptions, and advertising.

Amazon’s impressive profit margins reflect its efficient operations and strategic investments. The company’s relentless focus on innovation and operational excellence enables it to optimize costs and drive profitability across its business segments. Amazon’s scale and global reach also provide significant leverage in negotiating favorable terms with suppliers and partners, further enhancing its bottom line.

Moreover, Amazon’s ability to generate shareholder value is evident in its consistently delivering strong quarterly results. Investors are drawn to Amazon’s track record of growth and profitability, as evidenced by its stock performance and market capitalization. The company’s commitment to maximizing shareholder returns is reflected in its prudent capital allocation strategies, including investments in research and development, acquisitions, and capital expenditures to fuel future growth.

4- Prime Membership Loyalty:

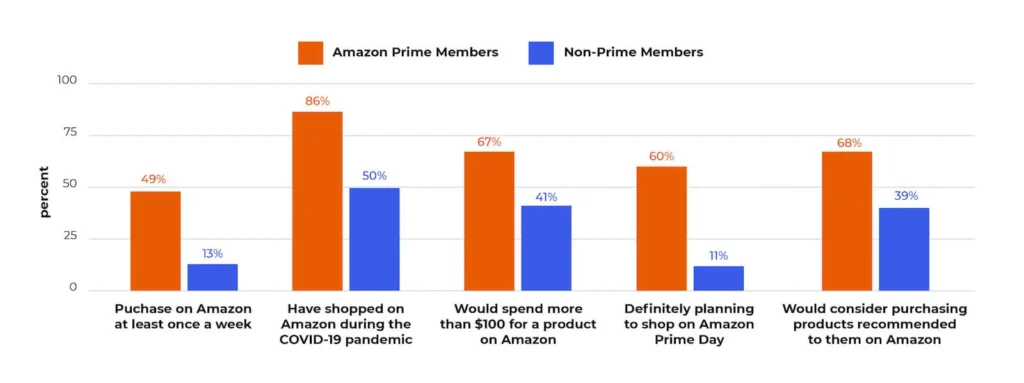

Amazon Prime membership loyalty is deeply ingrained in households worldwide, serving as a cornerstone of Amazon’s success. The membership program offers many benefits, including expedited shipping and access to a digital content library through Prime

Video, Prime Music, and Kindle Unlimited. This comprehensive suite of perks caters to diverse consumer needs, enhancing the value proposition of Prime membership.

One of the critical drivers of Prime membership loyalty is the convenience and reliability of fast shipping. With options like Prime Free One-Day and Same-Day Delivery, members can enjoy the convenience of receiving their orders quickly, often within hours of placing them. This seamless shopping experience saves time and reinforces customer satisfaction and loyalty.

Moreover, Prime’s exclusive deals and discounts incentivize members to shop more frequently on Amazon’s platform, increasing spending and customer retention. These exclusive offers, available only to Prime members, create a sense of exclusivity and value, further strengthening the bond between customers and the Amazon brand.

5- Visionary Leadership:

Amazon’s visionary leadership, spearheaded by founders like Jeff Bezos or the current CEO, embodies a commitment to long-term vision and innovation that sets the company apart. From its inception, Amazon has been driven by a bold vision to redefine the possibilities of e-commerce and beyond. Under the guidance of visionary leaders, Amazon has consistently pushed boundaries and embraced disruptive technologies to stay ahead of the curve.

Jeff Bezos, in particular, is renowned for his relentless pursuit of innovation and customer-centric philosophy. His visionary leadership has shaped Amazon’s culture of experimentation, risk-taking, and relentless pursuit of excellence. Bezos’s famous “Day 1” mantra reflects Amazon’s perpetual innovation and customer obsession ethos, emphasizing the importance of maintaining a startup mindset even as the company grows.

Amazon’s track record of bold bets and strategic investments speaks volumes about its visionary leadership.

Also read: Binbex Top 5 Strategies To Maximize Your Profits

Expert Recommendations On Amazon Stock:

1- Insights from Financial Analysts:

Financial analysts provide valuable insights into Amazon’s stock performance and potential.

Analysts offer recommendations on buying, selling, or holding Amazon stock through in-depth analysis of financial metrics, market trends, and competitive landscape.

Their assessments often consider revenue growth, profit margins, competitive positioning, and macroeconomic conditions, providing investors with informed guidance to make strategic investment decisions.

2- Institutional Investors’ Perspectives:

Institutional investors, including pension, mutual, and hedge funds, wield significant influence in the stock market.

Institutional investors often have significant stakes in Amazon and closely monitor its performance, governance practices, and long-term prospects.

3- Independent Experts’ Opinions:

Independent experts, including industry analysts, consultants, and thought leaders, offer impartial assessments of Amazon’s business strategy, competitive advantages, and growth prospects.

Drawing on their deep industry knowledge and research expertise, independent experts provide valuable insights into Amazon’s positioning within the market, potential risks and opportunities, and emerging trends that may impact its future performance. Their unbiased perspectives help investors gain a holistic understanding of Amazon’s investment potential and make well-informed decisions.

Key Metrics to Evaluate Amazon’s Stock:

- Revenue Growth: Amazon’s revenue growth rate is a fundamental metric to assess its performance. Increasing revenue indicates growing demand for Amazon’s products and services, while declining revenue may signal market challenges or saturation.

- Profit Margins: Profit margins, including gross margin, operating margin, and net margin, provide insights into Amazon’s profitability. Higher margins suggest efficient operations and pricing power, while narrowing margins may indicate increased competition or rising costs.

- Free Cash Flow: Free cash flow counts the cash generated by Amazon’s operations after accounting for capital expenditures. Positive free cash flow indicates the company’s ability to generate cash and fund growth initiatives, dividends, or share buybacks.

- Market Share: Tracking Amazon’s market share in key segments, such as e-commerce, cloud computing, and digital entertainment, provides insights into its competitive position and potential for growth relative to competitors.

- Innovation and Investment: Assessing Amazon’s investments in research and development, technology infrastructure, and strategic acquisitions helps evaluate its commitment to innovation and long-term growth.

- Debt Levels: Monitoring Amazon’s debt levels, including total debt-to-equity ratio and interest coverage ratio, helps assess its financial leverage and ability to meet debt obligations.

- Valuation Metrics: Valuation metrics such as price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and enterprise value-to-EBITDA ratio help determine whether Amazon’s stock is overvalued, undervalued, or moderately priced relative to its earnings and revenue.

- Regulatory and Legal Risks: Evaluating regulatory and legal risks, including antitrust investigations, data privacy concerns, and labor practices, helps assess potential threats to Amazon’s operations and reputation.

- Macroeconomic Factors: Considering macroeconomic indicators such as consumer spending, GDP growth, and interest rates helps contextualize Amazon’s performance within broader economic trends and anticipate potential impacts on its stock price.